Credit repair experts

We know your credit history is valuable. We are credit repair experts. Find out how we can help you

All Cloud Credit Solutions customers experience improvements in their credit scores in as little as three months.

What is credit repair?

Credit repair seeks to correct errors in your financial history so you can have a better and stronger credit record. This allows you to borrow or apply for loans or credit cards more easily and get better interest rates

Years of experience

Mortgage approvals

Approvals for automotive loans

New loan approvals

Request a consultation and credit analysis

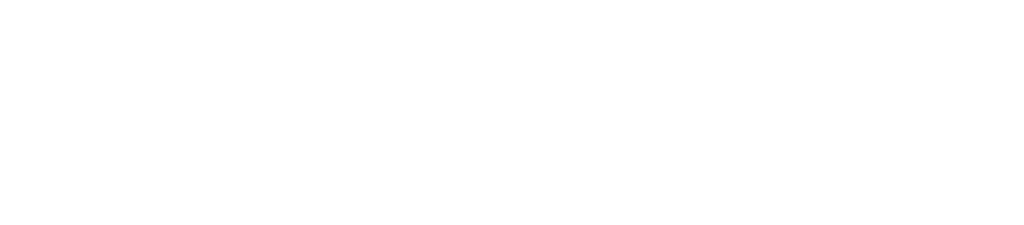

How does the process work?

Credit repair seeks to correct negative information contained in your credit report, such as accounts in collections, late payments, uncollectible charges and other items that may be negatively affecting your credit score.

Why Choose Cloud Credit Solutions?

At Cloud Credit Solutions, our passion is to help you reach your financial goals. We have a solid background in credit repair and provide you with personalized and dedicated attention at all times. In addition, our mission is not limited to repairing your credit; we also offer financial education so you can maintain a solid financial future. We work ethically and professionally every step of the way.

Experts in credit repair

Lo que dicen nuestros clientes de nosotros

Leave your credit repair in the hands of the experts

We’ll work every day to improve your credit in less than 90 days

What does our program include?

- Comprehensive Analysis

- Dispute of Errors

- Creditor Negotiation

- Customized Plan

- Continuous Monitoring

- Financial Education

- Proven Results

- Expert Team

- Regulatory Compliance

Other

Companies

Start unlocking and fixing your credit today

Get your credit evaluation now for as little as $1!

- Updated credit report from Equifax, Experian and TransUnion.

- FREE Negative Marks Analysis

- FREE score improvement recommendation

Before we get started we're going to need the following information from you!

Don’t worry – your data is protected and will not affect your score!

Comparison of Debt Solutions

Credit repair focuses on identifying and correcting errors or problems on your credit report that may be negatively affecting your credit score. This approach focuses on improving your credit history and removing negative marks, which can open doors to better interest rates and credit opportunities

Debt consolidation involves combining several debts into one, usually through a loan or line of credit with lower interest rates. This makes it easier to manage your debts and can reduce monthly payments. However, it doesn’t eliminate debt, it just reorganizes it.

Credit counseling is a process in which you work with a financial professional to develop a plan to help you manage your debt effectively. This approach does not eliminate debt, but provides strategies to better manage it and avoid future credit problems